|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding the Best Pet Insurance in CT: A Comprehensive GuideWhy Consider Pet Insurance?Pet insurance can be a lifesaver for your furry friends. It helps cover unexpected veterinary costs, providing peace of mind for pet owners. With the right plan, you can ensure your pet gets the best care without financial stress. Financial SecurityHaving pet insurance means you're prepared for emergencies. Imagine your cat needing surgery; with insurance, you can focus on their health rather than the cost. Comprehensive Coverage

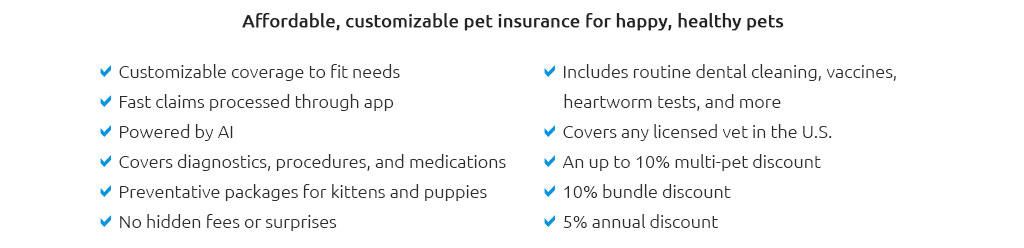

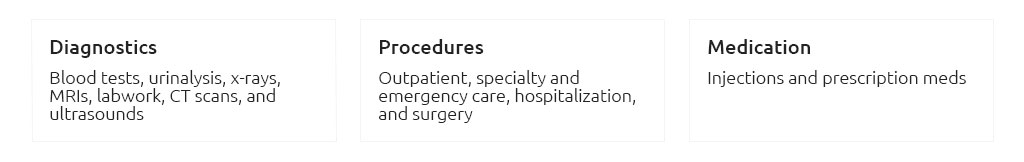

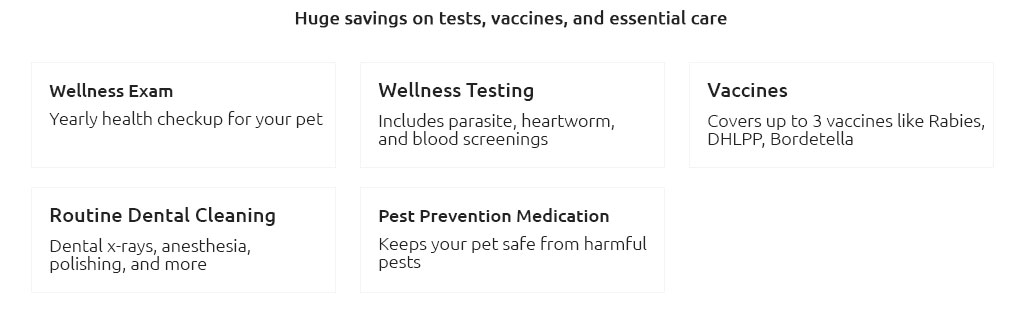

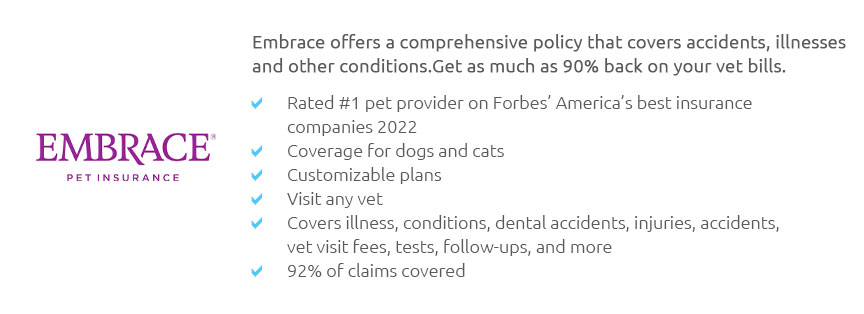

Many plans offer coverage for a variety of situations, ensuring your pet's needs are met. Top Features to Look ForChoosing the right pet insurance requires understanding key features. Consider these factors: Coverage LimitsLook for plans with high or unlimited coverage limits to avoid unexpected expenses. Reimbursement LevelsCheck the percentage of costs reimbursed by the insurer; common options are 70%, 80%, or 90%. If you're curious about the cost for specific pets, you might find it helpful to learn how much is pet insurance for a cat. DeductiblesChoose a deductible that fits your budget; lower deductibles generally mean higher premiums. Leading Providers in ConnecticutConnecticut offers a variety of pet insurance providers. Here are a few popular ones:

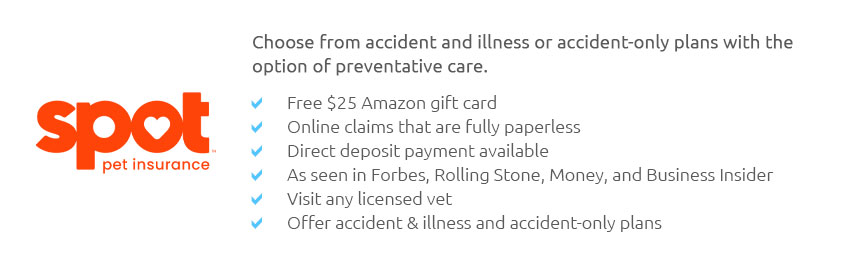

These companies are known for their comprehensive plans and excellent customer service. Frequently Asked QuestionsWhat does pet insurance typically cover?Most plans cover accidents, illnesses, surgeries, and sometimes routine care. It's important to review each policy for specifics. How do I choose the right deductible?Consider your financial situation. A higher deductible means lower monthly premiums, but you'll pay more out-of-pocket during a claim. Can I get insurance for exotic pets?Yes, some insurers offer plans for exotic pets. For example, you can see how much is pet insurance for birds to get an idea of coverage options available. Are pre-existing conditions covered?Most insurers do not cover pre-existing conditions, so it's best to get insurance while your pet is healthy. https://www.metlifepetinsurance.com/state/connecticut/

MetLife Pet Insurance helps pet parents in Connecticut with accident and illness coverage and much more ... pets deserve only the best pet ... https://www.fetchpet.com/locations/ct-pet-insurance

Get the best pet insurance in Connecticut for your dog or cat. Fetch offers the most comprehensive coverage in Connecticut and in all of the U.S.. https://www.usnews.com/insurance/pet-insurance/spot

What Does Spot Pet Insurance Cover? - Acupuncture - Advanced care - Alternative therapies - Blood tests - Chemotherapy - CT scans - Euthanasia - Hospitalizations ...

|